The buzz around BlueSky Social stock is undeniable. Whether you’re a seasoned investor or a tech enthusiast, chances are you’ve come across the name. But what exactly is BlueSky Social? And why is its stock becoming such a hot commodity? Let’s unpack everything you need to know.

What is BlueSky?

BlueSky is a decentralized social media platform designed to revolutionize how users interact online. Unlike traditional platforms like Twitter or Facebook, BlueSky Social gives users control over their data through decentralization. It’s built on the AT Protocol, which ensures secure and transparent interactions while allowing users to migrate seamlessly between apps.

Who Owns BlueSky Social?

BlueSky Social was initiated with support from Jack Dorsey, the co-founder of Twitter. Its current CEO, Jay Graber, leads the project. Graber’s vision is to create an internet ecosystem where users, not corporations, dictate the rules.

Why is BlueSky Social Stock in the Spotlight?

Investors are flocking to BlueSky Social stock for several reasons. Here’s a breakdown:

-

A Shift in Social Media Preferences

Users today demand more control, privacy, and transparency. Platforms like BlueSky Social fulfill these demands by putting the power back into the users’ hands. Unlike traditional social media giants like Twitter, BlueSky offers a decentralized alternative that’s secure and adaptable.

-

Backing by Industry Leaders

Having #Jack Dorsey involved brings undeniable credibility. His track record with Twitter gives investors confidence. The leadership team, including #Jay Graber, also reinforces the platform’s vision and potential.

-

Rising Popularity Among Users

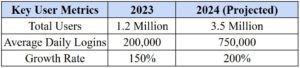

BlueSky Social is steadily gaining users. Whether through its seamless login system (BlueSky login) or its intuitive interface, users find it appealing. Platforms like Threads and Reddit have seen competitors emerge, but BlueSky stands out for its decentralized focus.

Such numbers not only show growing interest but also hint at strong revenue potential.

Figure: Bluesky social stock revenue comparison

-

Promising Revenue Model

BlueSky Social stock has seen an uptick due to its promising financial outlook. Unlike traditional ad-based platforms, BlueSky focuses on subscription models and user donations. This approach reduces reliance on intrusive advertising.

-

BlueSky’s Place in the Decentralized Market

While competitors like Threads (Meta’s social app) and Reddit focus on centralized systems, BlueSky is carving its niche. Its emphasis on user autonomy gives it an edge. The future of social media stocks may very well lie in decentralization.

BlueSky Social Stock: Opportunities and Challenges

While the stock seems promising, let’s take a closer look at the opportunities and potential hurdles.

Opportunities for BlueSky Social Stock

- Decentralization Trend: The global shift toward decentralization benefits BlueSky.

- Expanding Market: With millions exploring BlueSky login, the user base is rapidly growing.

- Cross-Platform Compatibility: Its AT Protocol allows integration across platforms.

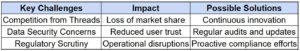

Challenges Facing BlueSky Social

- Competition: Giants like Threads and niche apps like Mastodon pose stiff competition.

- Regulations: As decentralization grows, governments may impose restrictions.

- Scalability: Meeting the demands of millions while maintaining performance is critical.

Figure: Bluesky social stock: Opportunities and challenges

What Makes BlueSky Unique?

BlueSky’s social media stock is gaining traction because of its unique features. Here’s why:

- Decentralization: Users own their data. No hidden agendas, no intrusive algorithms.

- Transparency: Every decision and change is out in the open.

- User-Focused Innovation: From customizable banners (BlueSky Social banner size) to personalized handles, the platform prioritizes user experience.

The Role of BlueSky in a Competitive Market

BlueSky faces stiff competition from platforms like Twitter and Threads, but its approach gives it a distinct advantage. Its decentralized system aligns with the growing distrust of centralized platforms. This factor makes BlueSky Social stock highly attractive to investors betting on the next big thing in tech.

Future Growth Projections

Investors are keeping a close eye on BlueSky. Why? Because it has the potential to scale like Twitter or Facebook did in their early days. Here are some growth predictions:

- 2025 Market Valuation: Estimated to reach $5 billion.

- User Base Expansion: Expected to double in two years.

- Revenue Streams: Focused on subscription-based models and user-supported funding.

BlueSky’s Competitive Edge

Its AT Protocol gives it a technological advantage. This system connects users across platforms seamlessly. Think of it as the backbone of decentralized social media.

Cybersecurity Risks and Potential Scams on BlueSky Social

While BlueSky Social champions decentralization and user privacy, it is not immune to cybersecurity threats. As the platform grows in popularity, it faces unique challenges that every user and investor should be aware of.

- Risks of Decentralized Systems

Decentralization offers numerous benefits, but it also comes with certain vulnerabilities:

- Data Responsibility: Unlike centralized platforms, users are responsible for managing their data securely. If users lose access to their private keys or credentials, they may lose access to their accounts permanently.

- Phishing Attacks: Cybercriminals often exploit new platforms. Fake emails, links, and login pages claiming to be from **BlueSky Social** could trick users into sharing sensitive information.

- Possibility of Scams

With BlueSky’s growing user base, scammers may exploit the platform for fraudulent schemes:

- Fake Investment Opportunities: Fraudsters could create fake BlueSky Social stock investment schemes, promising high returns to unsuspecting victims. Investors should only deal with verified brokers or trusted platforms.

- Impersonation Scams: Decentralized platforms may lack robust verification systems initially. Scammers could impersonate high-profile users, celebrities, or organizations to deceive others.

-

Privacy and Data Breaches

While BlueSky uses the AT Protocol to ensure privacy, no system is entirely immune. Hackers could target:

- Vulnerable Applications: Third-party apps integrating with BlueSky could be exploited to steal user data.

- Metadata Harvesting: Even with decentralization, some metadata like login times or interactions could be tracked if security measures aren’t stringent.

Figure: Security concern and solution

-

How BlueSky Can Mitigate Risks

BlueSky must address these cybersecurity challenges proactively. Here’s what the platform is doing (and should do):

- Two-Factor Authentication (2FA): Encouraging users to enable 2FA adds an extra layer of security.

- Education: Providing resources to users about phishing and scams can reduce risk.

- Regular Audits: Conducting security audits for the BlueSky app and affiliated third-party applications ensures vulnerabilities are patched promptly.

- User Reporting Systems: Creating robust systems to report and address impersonation or scam accounts.

Takeaway for Investors and Users

While BlueSky Social has immense potential, its cybersecurity challenges are worth noting. Investors should monitor how the company addresses these risks, as mishandling could impact user trust and stock value. Users, on the other hand, must stay vigilant and adopt best practices for online safety.

By addressing these issues early, BlueSky Social can maintain its reputation as a secure and innovative platform.

This section integrates seamlessly into the article, enhancing its value by providing crucial insights into the platform’s challenges and how users and investors can navigate them.

Conclusion

The rise of BlueSky Social stock isn’t just a financial trend; it’s a reflection of changing social media dynamics. With decentralization, user autonomy, and Jack Dorsey’s backing, BlueSky is poised for growth. However, like any investment, it carries risks. Stay informed, analyze the market, and consider BlueSky as part of a diverse portfolio.

FAQs

1. What is BlueSky Social?

Answer: It’s a decentralized social media platform giving users control over their data.

2. Who owns BlueSky Social?

Answer: The project was initiated by Jack Dorsey and is led by Jay Graber.

3. Why is BlueSky Social stock popular?

Answer: Its decentralized approach and strong leadership make it appealing to investors.

4. How does BlueSky compare to Threads?

Answer: Unlike Threads, BlueSky focuses on decentralization and user autonomy.

5. Is BlueSky Social stock a good investment?

Answer: It has potential, but investors should analyze risks and consult advisors.

6. how to invest in bluesky social?

Answer: To invest in BlueSky Social, check if its stock is publicly listed on major stock exchanges. If it’s a private company, you might need to wait for an IPO or explore venture capital opportunities. Always consult a financial advisor for guidance.